TermScout Announces Top 2019 Cloud Service Provider Contract Ratings

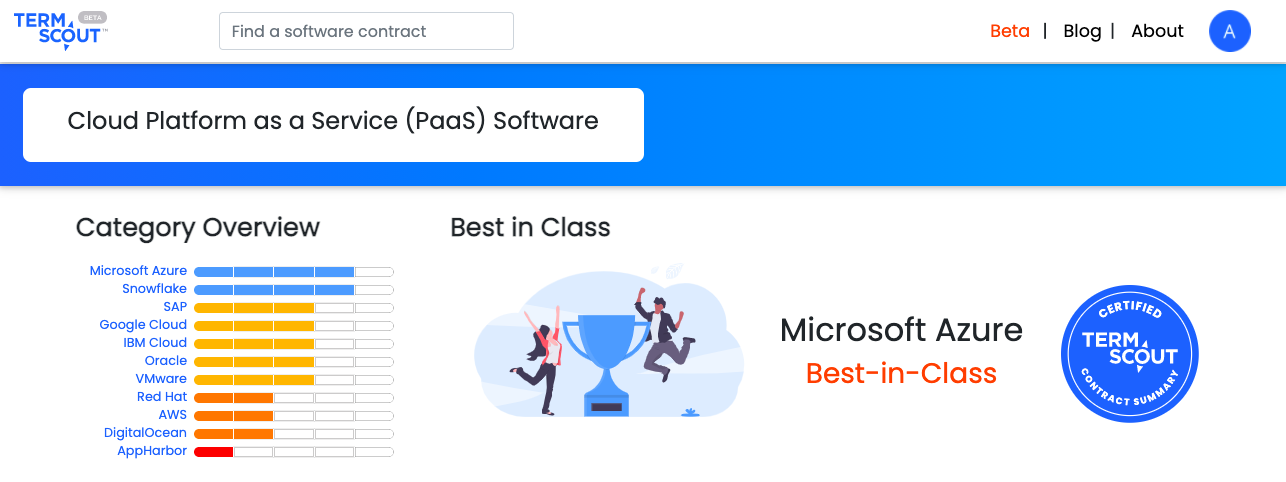

Today, TermScout released its first semi-annual Cloud Services Provider Contract Ratings. These ratings represent the overall findings of TermScout’s analysis into the customer-friendliness of customer agreements in the cloud services industry.

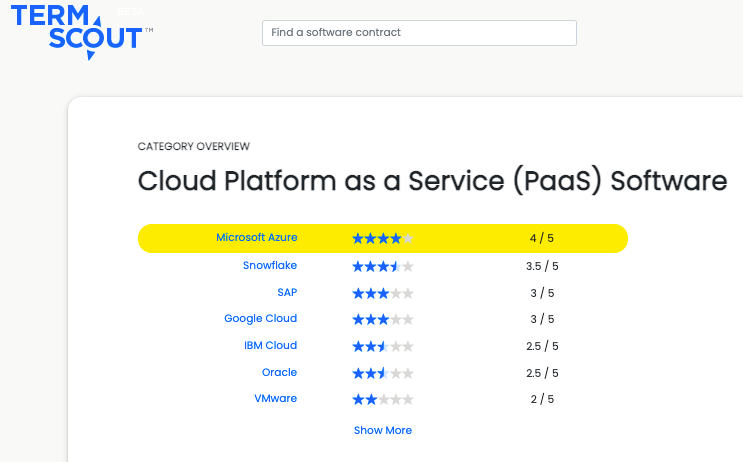

TermScout started this project by interviewing and surveying more than 100 cloud customers to understand what issues matter most to them when purchasing and using cloud services. TermScout then analyzed the standard customer agreements of Amazon Web Services, Google Cloud Platform, IBM Cloud, Microsoft Azure, and Oracle Cloud, using its proprietary reviewing and scoring methodologies, TermScores. After analyzing these companies’ contracts, policies, exhibits, and appendices, which often exceed 100 pages of nested terms and complicated legalese, TermScout rated each company on the primary contract provisions that matter most to the typical cloud customer. These ratings were then weighted according to the importance of each as determined by TermScout’s market research and legal team to arrive at an overall score for each company. The results are displayed in Table 1 below.1

“We hope these results will help cloud customers make more informed decisions about what they’re signing up to,” said Otto Hanson, Chief Executive Officer at TermScout. “These contracts determine what happens when something goes wrong with a cloud provider, such as a data breach. Customers have many options when it comes to cloud providers – now for the first time ever they can factor contract fairness into their decision about which provider to choose.”

In a recent survey of 450 consumers, 95% said they believe a company’s contracts are a reflection of its values and attitudes towards customers, and 44% would be very likely to stop using a company’s services after learning that its contracts are less fair than its competitors.

Interestingly, TermScout noted an inverse relationship between favorability of contracts and market share (i.e. the higher the market share, the less-favorable the contracts). See Table 2. This suggests that companies trying to compete for market share may be doing so in part by offering better terms to their customers.2 This discovery, combined with TermScout’s market research, validates a central thesis of TermScout: that customers care what’s in the contracts they sign and companies offering fair contracts can gain a competitive advantage.

The TermScout analysis revealed that in addition to having the best terms overall, Oracle had the best terms in the Warranties and Data Security categories and tied for second in Risk Allocation – all fields with heavy weights in TermScout’s rating algorithm. This consistency in providing customer-friendly terms throughout its agreements resulted in an overall score of 58/100, which was 9 points higher than the second-place finisher (IBM, at 49/100). “While Oracle has the best contracts among the top five providers, its terms are still far from perfect,” said Hanson. “For example, most customers would be disappointed to learn that Oracle does not exclude its indemnification obligations (or anything else) from the limitations on its liability.”

On the other end of the spectrum, Amazon Web Services (“AWS”), the leader in the industry by market share, had significantly worse terms than any of the competitors reviewed. AWS’s terms were especially unfavorable to customers in the Risk Allocation (by signing AWS’s agreements, you agree that AWS will never be liable to you for anything, no matter what), Warranty (AWS does not offer any warranties whatsoever), and Data Security (AWS does not publish a breach notification policy and makes only vague contractual commitments to protect its customers’ data) categories.

Additional Information

You can purchase the complete Industry Report or full individual Company Reports here. Each TermScout report includes simple explanations of complicated contract terms, detailed analysis of potential legal issues, and citations to the original agreements. Additional comparative analysis and negotiating tips provide the reader with the ammunition needed to demand better terms when negotiating with cloud services providers. The full Industry Report also includes complete category rankings for each of the companies.

- View TermScout’s contract analysis methodology here.

- To discuss opportunities to work with TermScout to understand other company’s contracts and to make sure your company’s contracts are fair, or for questions about this press release, email info@termscout.io.

About TermScout

TermScout’s mission is to help people and businesses understand the contracts they sign. We started TermScout at the Global Legal Hackathon in 2018 (called LexLucid then). After winning in Denver, regionals, and then finals, we knew we were onto something, so we pulled a team and some resources together and started building. We’re based in Denver, Colorado, with a team of experienced and passionate attorneys, entrepreneurs, and engineers.

1 The TermScores mentioned here are based on the versions of the cloud company contracts that were current as of the date of this press release. To see if any scores have changed, email info@termscout.io.

2 Market share numbers found at https://www.canalys.com/newsroom/cloud-market-share-q4-2018-and-full-year-2018 on September 3, 2019. TermScout did not independently verify this information. Market share data for Oracle was not listed on Canalys article but is estimated to be close to IBM.

Share this

You May Also Like

These Related Stories

TermScout Launches Contract-Rating Platform with Free Comparisons of Over 150 Software Companies

Contract Terms Shootout – How Do the Top 10 Cloud Companies’ Contracts Compare?

.png?width=130&height=53&name=Vector%20(21).png)