What’s Market: Customer’s Indemnification Obligations

The What’s Market series is an ongoing look at and breakdown of the various clauses found within contracts. Each article takes data gathered by TermScout, which uses AI assisted by contract professionals to analyze, benchmark and rate contracts, and breaks down the differences between vendor forms, customer forms, and negotiated contracts.

This article will look into something we’ve touched on in the past, Indemnification. However, unlike last time where the topic was Vendor’s Indemnification Obligations, this time the focus will be on the customer’s indemnification obligations and how common they are within contracts.

Indemnification Obligations

As previously discussed in the What’s Market series, indemnification is one of the most hotly debated clauses within contracts, as it relates to both vendor and customer’s indemnification obligations. Black’s Law Dictionary states that to indemnify is “To save harmless; to secure against loss or damage; to give a security for the reimbursement of a person in case of an anticipated loss falling upon him.

Also, to make good; to compensate; to make reimbursement to one of a loss already incurred by him.” When customers have indemnification obligations in a contract, they are obligated to protect the vendor, generally against third-party claims.

As an example, the customer has indemnification obligations for any third-party claims. The vendor provides software that allows third parties to make payments online.

One of the vendor’s customers has been abusing the system and fraudulently collecting money. Though it was the vendor’s software that allowed this action to occur, the indemnification obligations require that the customer protect the vendor from any third-party claims.

Vendor v. Customer v. Negotiated Contracts

The data TermScout collected showed vendor’s indemnification obligations to be one of the most crucial and hotly negotiated topics, so how do customer’s indemnification obligations stack up?

Are the customer’s indemnification obligations as polarizing, and what types of claims are covered? To answer both of these questions, TermScout has analyzed 614 vendor contracts, 102 customer contracts, and 95 negotiated contracts in order to determine the most accurate and definitive answers.

Since there are a multitude of claims that can be indemnified, we will only be displaying the top five types of claims percentage-wise for each section.

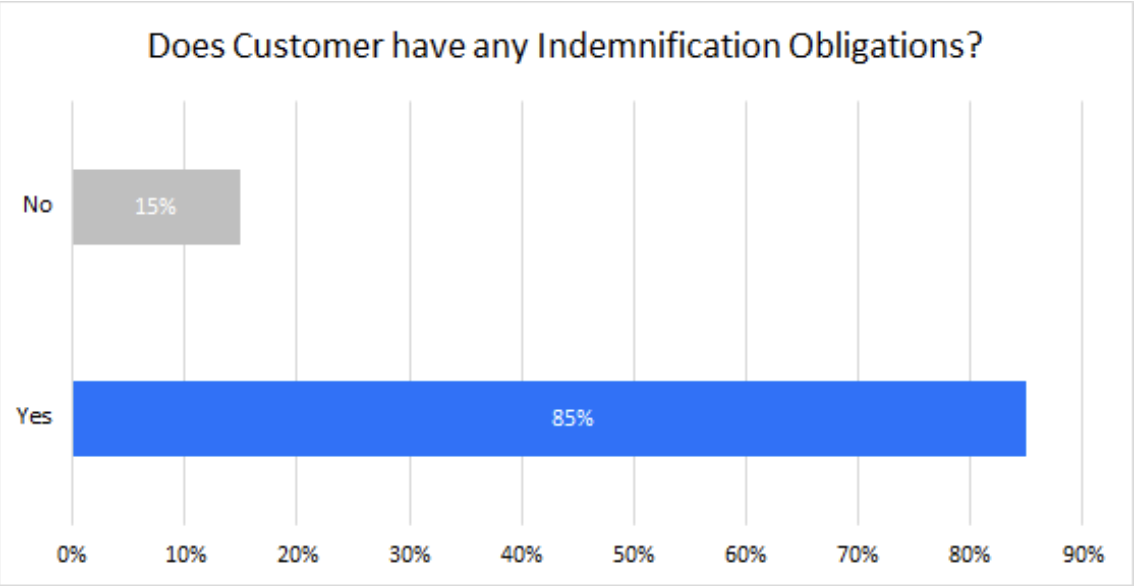

What Vendors Offer (614 vendor forms)

Right off the bat we can see that vendors, unsurprisingly, have a great interest in customers indemnifying them, with 85% of contracts including a clause for customers’ indemnification obligations.

Want to know if your terms are truly market standard?”

Benchmark with TermScout — no guesswork, just data.

Additionally, we can see the top five claims have a near even spread, with breach of contract, and customers' use of the service ranking #1 and #2 respectively.

With this we can get a clear picture of what’s most important to vendors, something that will differ when we look at the customer side.

Note: Covered claims are not mutually exclusive, so one contract can contain multiple indemnification obligations.

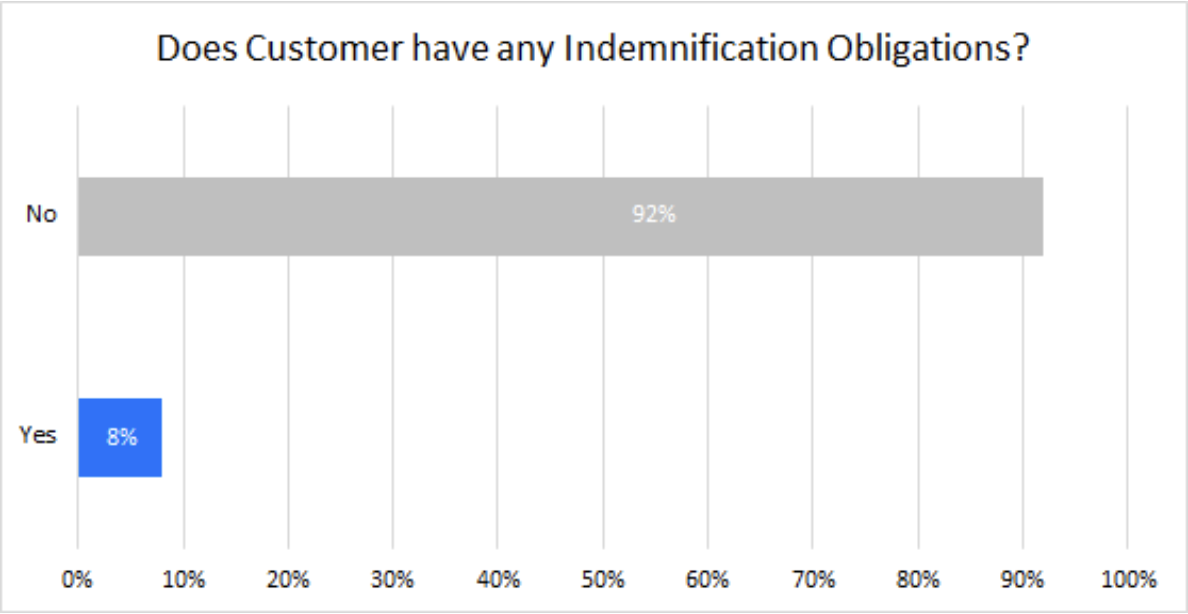

What Customers Offer (102 Customer forms)

While a similar pattern appears, with the data being heavily skewed in one direction, it is nearly opposite of what we saw in the vendor forms. Customers do not want to indemnify vendors almost unanimously, with 92% of customer forms not including any language or denying indemnification obligations for the customer.

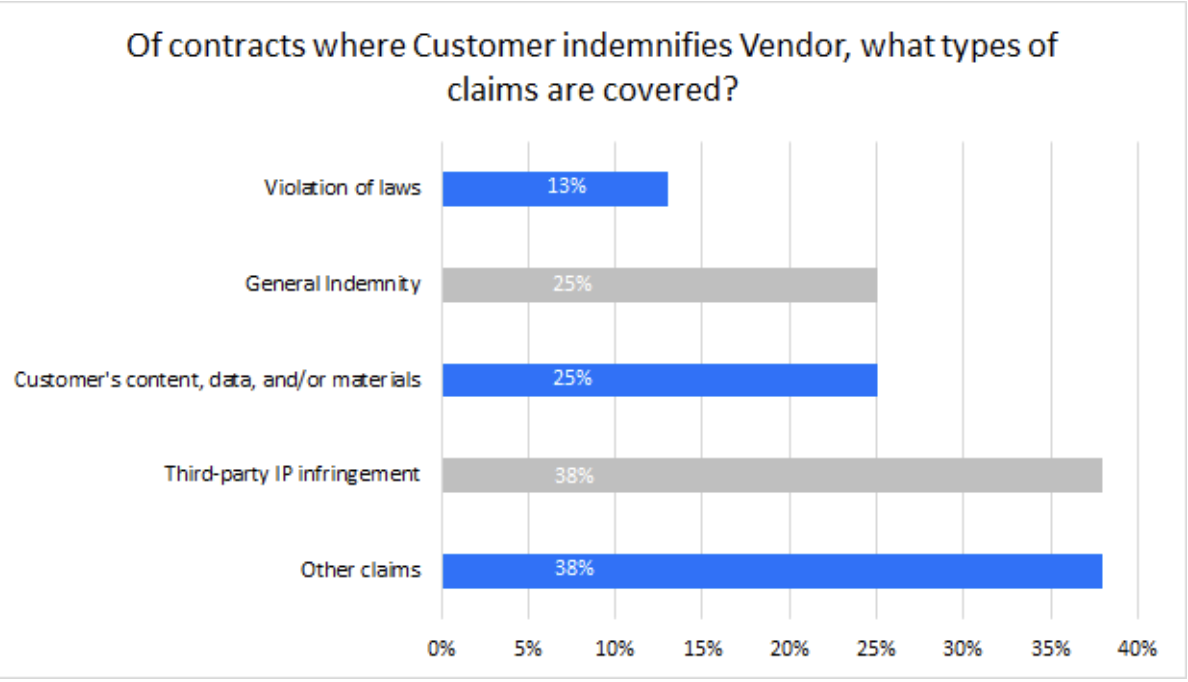

Interestingly enough, when there are obligations for the customer, the claims that are covered are far more spread out, with third-party IP infringement tied with ‘other claims’ – claims that do not fall into the other specified categories—for first place. It should be noted that although it is not the first priority, customers use of the service, which was the #1 claim for vendors, is still high on the list for customers, showing some agreement and understanding between the two parties.

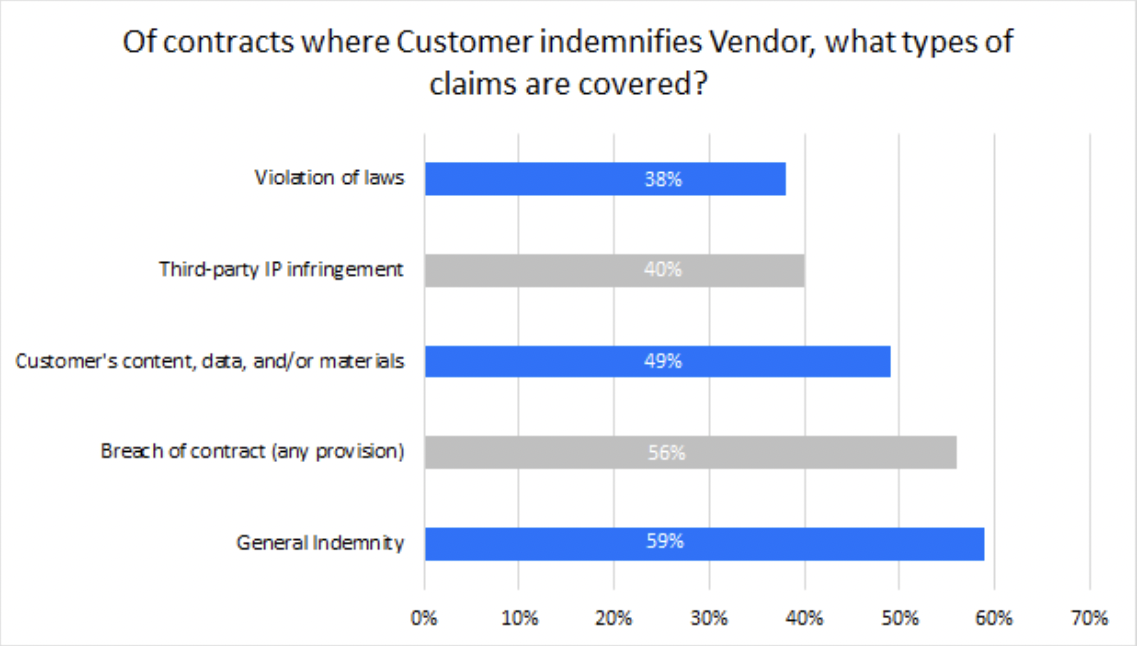

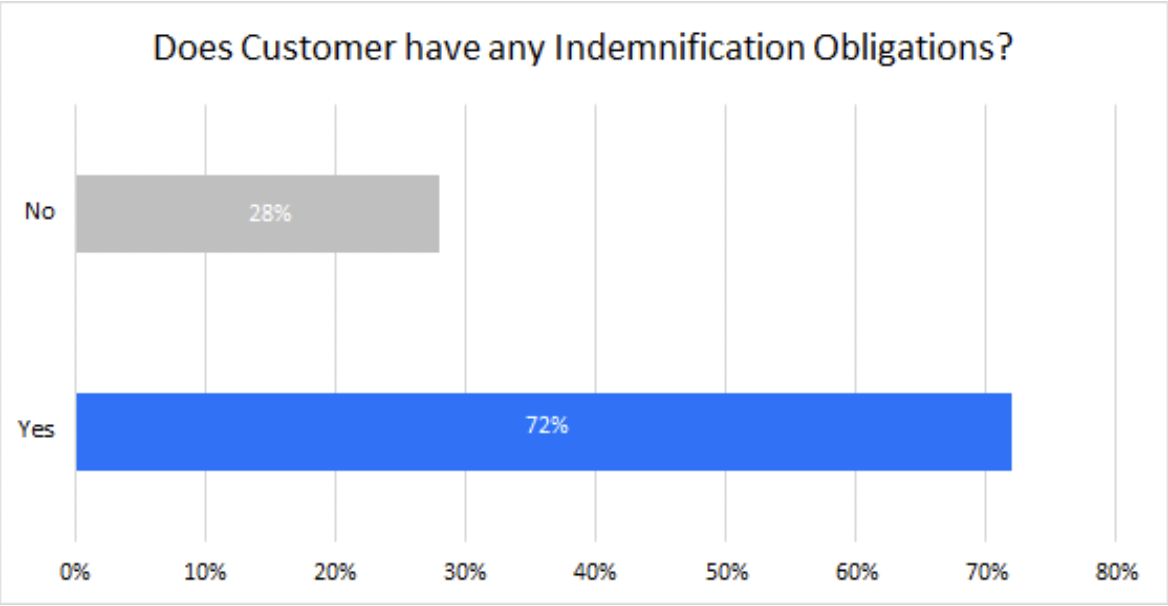

What Happens When Parties Negotiate (95 negotiated contracts)

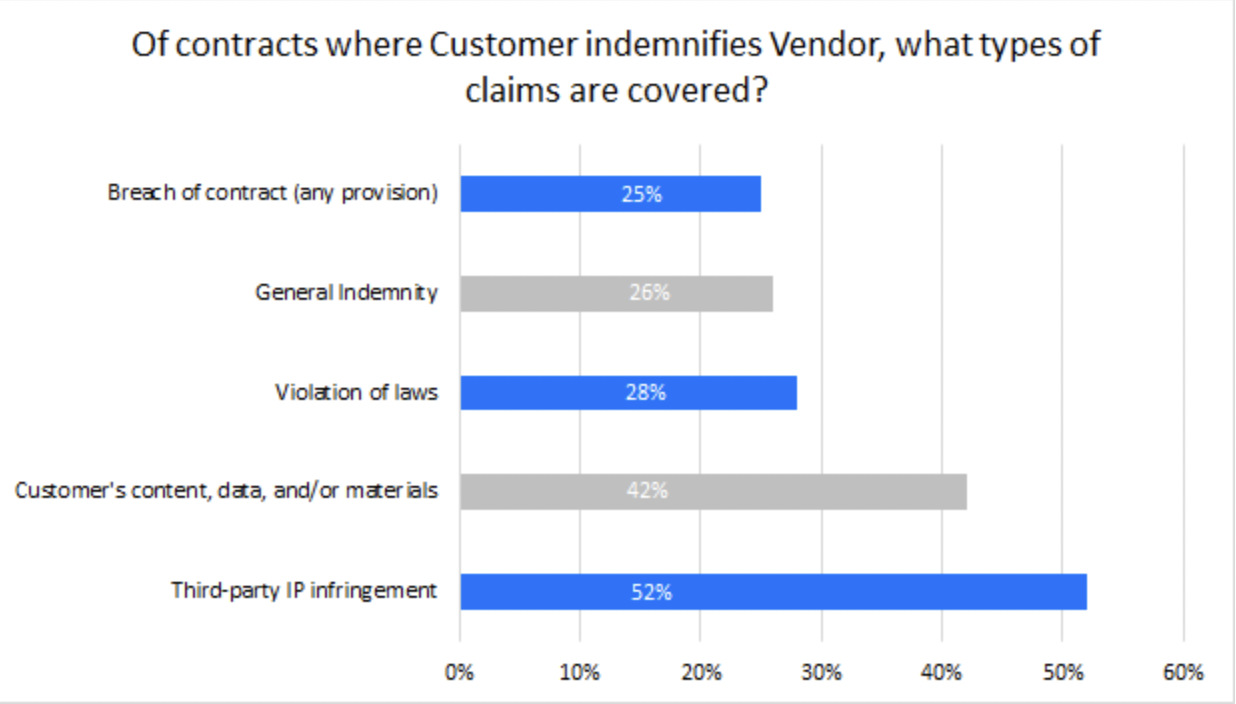

What stands out almost immediately is the high percentage of contracts that include customer’s indemnification obligations. With 72% of negotiated forms stating that customers have indemnification obligations, it is clear that the vendors are more successful in the negotiation on this point. Of course, this comes as no surprise since vendors are protecting themselves when adding such language, making it a high priority during the negotiation process.

Interestingly enough though, the claims that are indemnified lean more towards the customer’s preference, with third-party IP infringement and customer’s content taking the top two spots. This can go to show that the negotiation process can be successful, with both parties coming away with a win.

Representative Provisions

Examples of companies where customers have obligations:

- Automox: 8.2, Master Services Agreement

- MailChimp: 20, Standard Terms of Use

- Notion: 18, Terms and Conditions

- Outreach: Indemnification, Terms of Service

- SurveyMonkey: 12.5, Terms of Use

- UpKeep: 8.3, Terms of Use

- WordPress: 18, Terms of Service

- Zoom: 16, Terms of Service

Note: Examples of companies where the customer does not have indemnification obligations have been excluded from this list, as in almost all cases where this is true, it is due to the contract not addressing customer indemnification rather than clearly stating that the customer has no obligations.

Final Thoughts

It is clear that vendors want customers to indemnify them, as they want to be protected, especially against claims that result from situations outside of the vendor’s control. The importance of such protection becomes most clear when we look at the data for negotiated contracts, where 72% of contracts contain customer indemnification obligations.

Customers who find vendors pushing for customer indemnification obligations may wish to concede on the point in order to gain victories elsewhere in the negotiation process.

Similarly, vendors cannot expect to always have customer indemnification obligations written into the contract upfront and should prepare to negotiate for them.

Both sides can come out of the negotiation happy, and understanding what terms and clauses each party is going to push for can help greatly expedite the process.

Understanding indemnification obligations isn’t just important for legal teams managing risk; it’s also critical for sales teams looking to accelerate deal cycles, RevOps professionals aiming to streamline workflows, finance leaders responsible for forecasting and exposure, and marketing teams working to build trust through transparency.

Learn how legal teams and cross-functional stakeholders use TermScout to align contract terms with business outcomes.

Curious how your indemnification clause compares to 1,000+ real contracts? We’ll help you benchmark it instantly.

Talk to UsShare this

You May Also Like

These Related Stories

Vendor Indemnification Obligations: What’s Market in IT, SaaS, and PaaS Contracts

What’s Market? Term & Termination

%20(4)-2.jpeg?width=1920&height=1080&name=Untitled-6-(Presentation)%20(4)-2.jpeg)

.png?width=130&height=53&name=Vector%20(21).png)